Bacon Flavors Market Size to Exceed USD 2.76 Billion by 2035 | Towards FnB

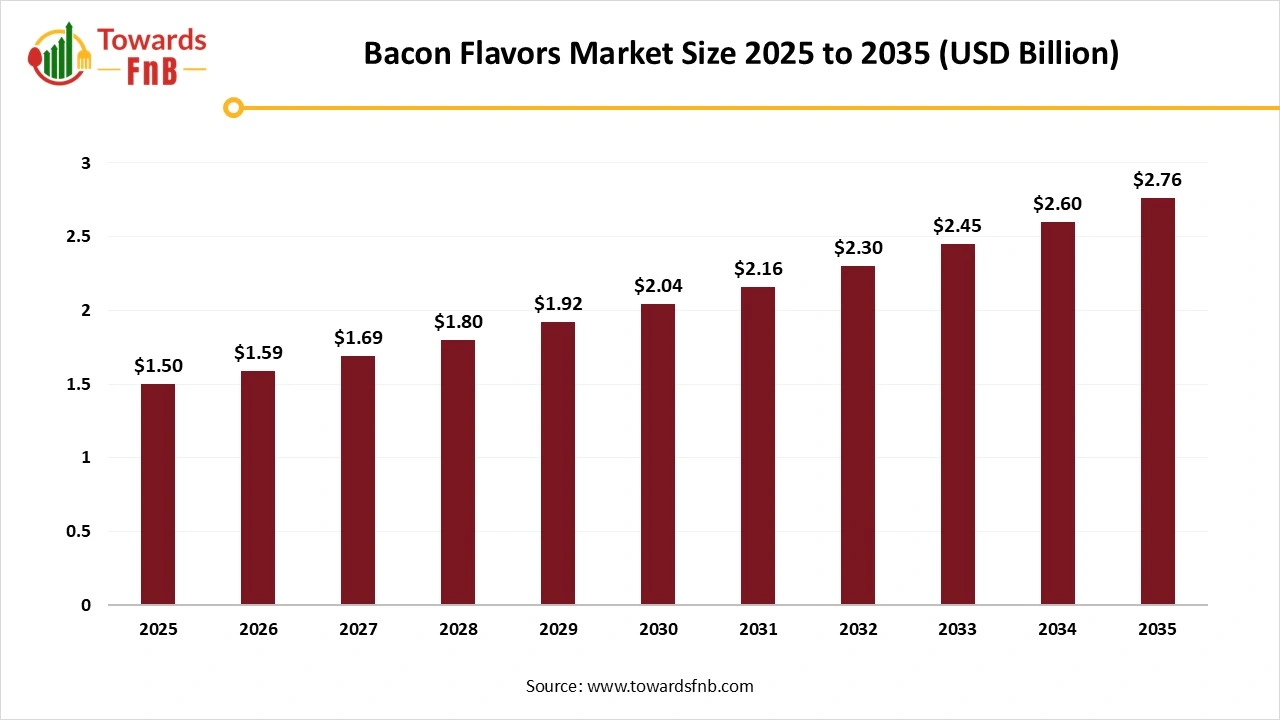

According to Towards FnB, the global bacon flavors market size is evaluated at USD 1.59 billion in 2026 and is expected to reach USD 2.76 billion by 2035, registering a CAGR of 6.3% during the 2026 to 2035 forecast period. This trajectory reflects expanding use of bacon flavor systems across multiple food categories, including snacks, sauces, and alternative protein products.

Ottawa, Jan. 29, 2026 (GLOBE NEWSWIRE) -- The global bacon flavors market size stood at USD 1.50 billion in 2025 and is predicted to grow from USD 1.59 billion in 2026 to reach around USD 2.76 billion by 2035, as reported by Towards FnB, a sister firm of Precedence Research. This valuation underscores the increasing role of bacon flavors as functional ingredients that help standardize taste and reduce formulation complexity in mass-produced foods.

The market is expected to grow significantly due to high demand for flavor innovations in processed and fast food options. Higher demand for smoky and savory taste profiles in snacks and different types of fast food options is another major factor for the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5998

Key Highlights of Bacon Flavors Market

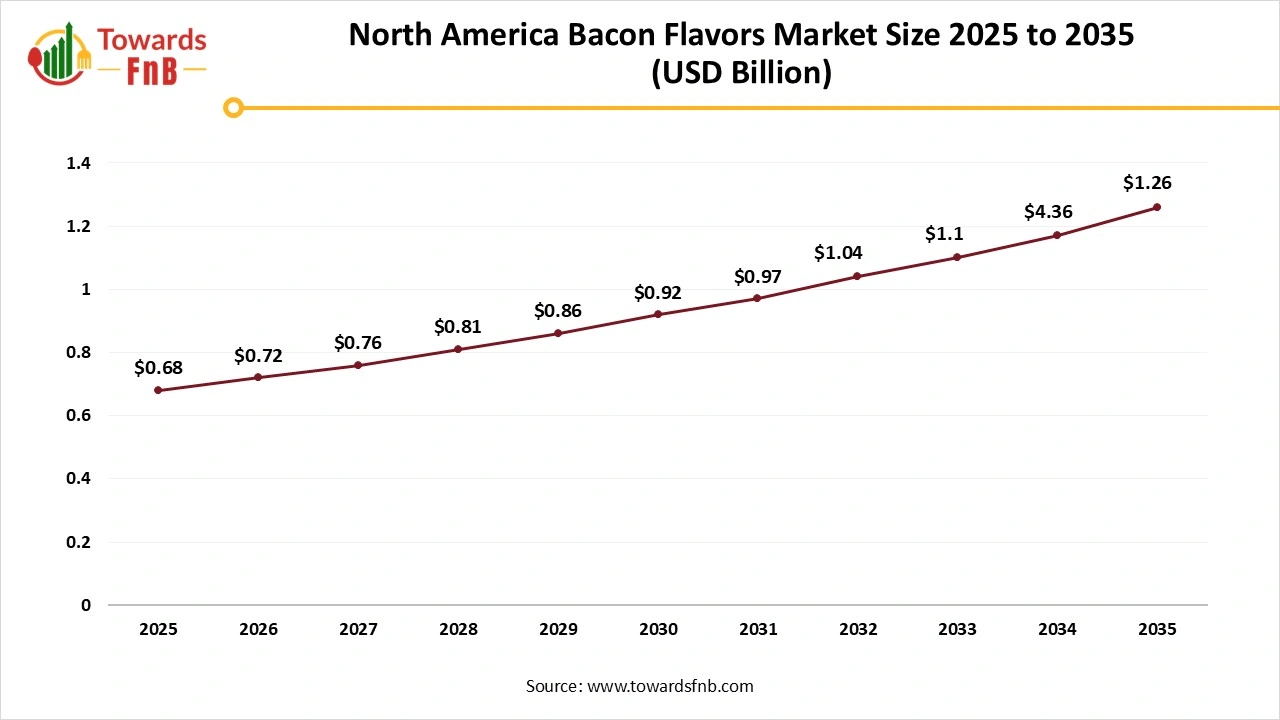

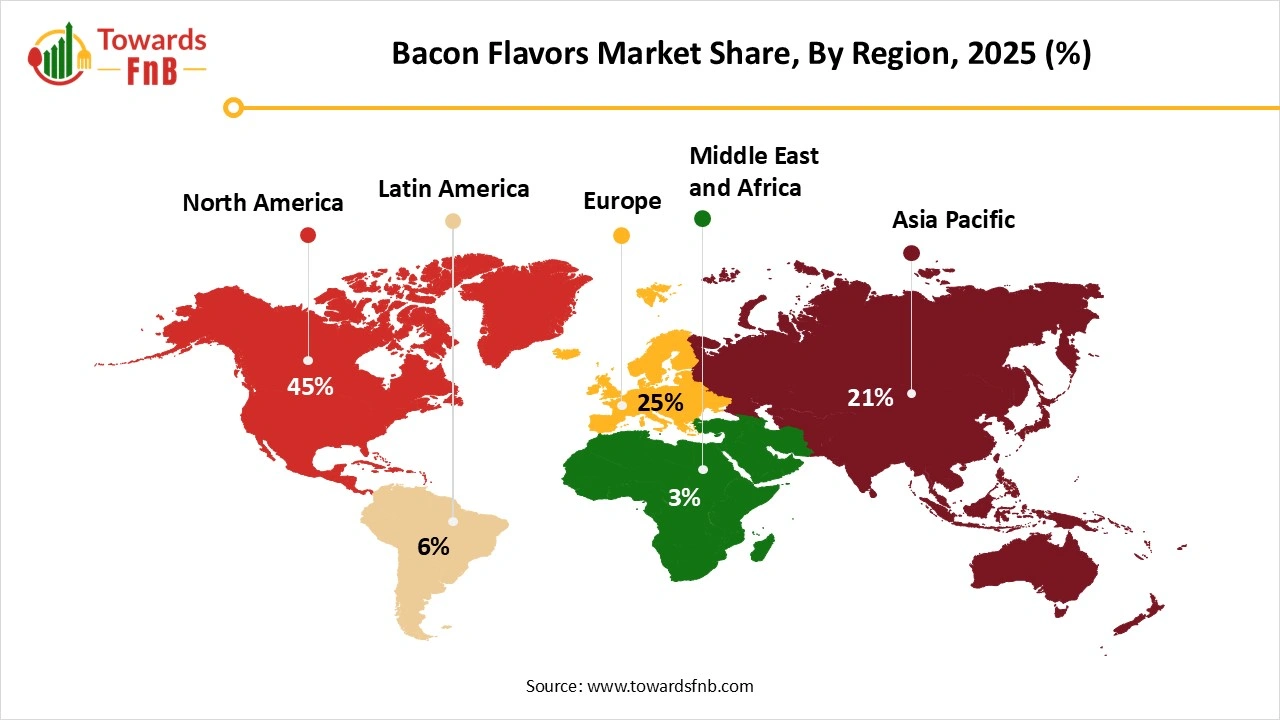

- By region, North America led the bacon flavors market with highest share of 45% in 2025, whereas the Asia Pacific is expected to grow in the forecast period.

- By flavor type, the smoke flavor segment led the bacon flavors market in 2025, whereas the hickory flavor segment is expected to grow in the foreseeable period.

- By application, the meat products segment led the bacon flavors market in 2025, whereas the potato chips and snacks segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarkets/hypermarkets segment led the bacon flavors market in 2025, whereas the online retail segment is expected to grow in the forecast period.

From an investment perspective, the bacon flavors market demonstrates resilient demand fundamentals, supported by diversification across end-use categories and increasing penetration into premium, plant-based, and functional food segments.

Higher Demand for Flavorful and Healthier Options Is Helpful for the Growth of the Bacon Flavors Industry

The bacon flavors market is observed to grow due to higher demand for rich, bold, and smoky bacon flavors in different types of food options. Higher demand for smoky bacon-flavored dips, sauces, and spreads to elevate the flavor profile also helps to fuel the growth of the market. Higher demand for such flavor profiles in household-level kitchens, restaurant-based kitchens, and other professional catering services also helps to fuel the growth of the market.

Technological Advancements in the Growth of Bacon Flavors Market

Technological advancements in the form of AI, automation, and improved extraction methods to elevate the product quality and performance are a major factor for the growth of the market. Such processes also help to manage the supply chain effortlessly and allow manufacturing industries to propel their businesses further, fueling the growth of the market.

Impact of AI in the Bacon Flavors Market (Global)

Artificial intelligence is increasingly being applied across the global bacon flavors market to improve flavor replication accuracy, raw material substitution, and consistency across food. snack, and plant-based product applications. Machine learning models analyze complex datasets covering Maillard reaction pathways, smoke-derived volatiles, lipid oxidation products, and sulfur-containing compounds to predict aroma intensity, flavor balance, and stability profiles associated with bacon-like sensory characteristics. In product development, AI accelerates formulation screening by modeling how different precursor combinations, reaction conditions, and carrier systems generate target bacon flavor notes, enabling rapid optimization of natural, nature-identical, and smoke-based flavor systems with fewer physical trials.

AI is also used to support plant-based and hybrid formulations by predicting how bacon flavor systems interact with non-meat protein matrices, fats, and processing conditions such as extrusion or baking. During manufacturing, AI-driven quality control tools correlate analytical data with sensory benchmarks to maintain batch-to-batch flavor consistency and manage volatility loss during storage and distribution. From a regulatory and quality perspective, AI assists in compositional verification, allergen risk screening, and specification alignment by mapping ingredient usage and flavoring components against international food safety and flavor standards referenced by the Food and Agriculture Organization and the Codex Alimentarius Commission.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/bacon-flavors-market

Recent Developments in Bacon Flavors Market

- In October 2025, Hormel Black Label Bacon and Frank’s RedHot joined hands for the launch of a new product- Hormel Black Label Frank’s RedHot flavored bacon.

- In October 2025, Godshall’s Quality Meats launched their newest product- Chicken Bacon, containing 75% less fat compared to pork bacon without any preservatives or MSG.

New Trends of Bacon Flavors Market

- Availability and higher demand for plant-based bacon options made from soy and pea by vegans and flexitarians are some of the major factors for the growth of the market.

- Higher demand for premium and unique flavor profiles, such as Applewood, Cherrywood, and maple, also helps to propel the growth of the market.

- Higher demand for pre-cooked and ready-to-eat bacon strips in different flavor options is another major factor helpful for the growth of the market.

Product Survey of the Bacon Flavors Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Natural Bacon Flavor | Flavor derived from natural meat extracts or thermal reaction processes | Liquid, paste, powder | Processed foods, snacks, sauces | Natural bacon flavor systems |

| Nature-Identical Bacon Flavor | Flavor compounds formulated to replicate bacon taste using nature-identical ingredients | Liquid and powder forms | Snack manufacturers, ready-meal producers | Nature-identical bacon flavors |

| Artificial Bacon Flavor | Fully synthetic flavor formulations delivering bacon profile at low dosage | Liquid concentrates, powders | Cost-sensitive food manufacturing | Artificial bacon flavor compounds |

| Smoke Bacon Flavor | Bacon flavor combined with smoke notes for enhanced authenticity | Liquid smoke blends, powders | Meat products, plant-based foods | Smoke-infused bacon flavors |

| Bacon Flavor for Snacks | Bacon flavor systems optimized for dry and fried snack applications | Heat-stable powders | Chips, extruded snacks, nuts | Snack-grade bacon flavors |

| Bacon Flavor for Processed Meats | Flavor systems designed to reinforce or standardize bacon taste | Liquid and paste formats | Sausages, deli meats, restructured meats | Meat-application bacon flavors |

| Bacon Flavor for Plant-Based Foods | Bacon-style flavors formulated without animal-derived ingredients | Vegan liquid and powder flavors | Plant-based meat and snack manufacturers | Vegan bacon flavor systems |

| Clean-Label Bacon Flavor | Bacon flavors formulated without artificial additives or declarable allergens | Natural reaction flavors | Clean-label and premium food brands | Clean-label bacon flavor formulations |

| Encapsulated Bacon Flavor | Flavor systems protected for stability and controlled release | Spray-dried encapsulated powders | Snacks, seasonings, instant foods | Encapsulated bacon-flavored ingredients |

| Custom Bacon Flavor Systems | Tailored bacon flavor profiles developed for specific applications | Application-specific blends | Flavor houses, large food manufacturers | Customized bacon flavor solutions |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5998

Bacon Flavors Market Dynamics

What are the Growth Drivers of the Bacon Flavors Market?

Higher demand for smoky, bold, and umami flavors is one of the major factors for the growth of the market. Hence, snacks with highly smoky and innovative flavor options are preferred by consumers of different age groups. Higher demand for convenient and ready-to-eat snack options by consumers with a hectic lifestyle also helps to propel the growth of the market. Consumers in search of high-protein, high-fat, and ketogenic-friendly options also help to fuel the growth of the market in the foreseeable period. Product innovation in the form of plant-based bacon options by upcoming manufacturers is another major factor driving the growth of the market.

Challenge

Growing Health Consciousness Hampering the Growth of Bacon Flavors Market

Growing awareness regarding the harmful ingredients used in processed meat, such as high volumes of sodium and nitrate, affects cardiovascular health and is a major driver of cancer. Availability of plant-based and healthier options in the market also hampers the sale of the traditional bacon industry, further restraining the growth of the overall market. Hence, factors altogether may restrain the growth of the bacon flavors market.

Opportunity

Availability of Plant-Based and Healthier Options is helpful for the Growth of the Bacon Flavors Market

The growing popularity of plant-based bacon made from soy and peas is one of the major factors for the growth of the market. The growing population of vegans, vegetarians, and flexitarians demanding plant-based options is another major factor propelling the growth of the market. Availability of such options easily on different platforms and in different forms is another major factor helpful for the growth of the market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Bacon Flavors Market Regional Analysis

North America led the Bacon Flavors Market in 2025

North America dominated the bacon flavors market in 2025, due to higher demand for convenient and processed food options, fueling the growth of the market. Availability of plant-based and protein-blended bacon options is another major factor in the growth of the market. These are also available in different flavor options. Such options are highly preferred by vegans and health-conscious consumers for a lower fat content, which is helpful for the market’s growth. Higher demand for ready-to-eat snacks, breakfast options, and protein bar options also helps to propel the market’s growth. The US has made a major contribution to the growth of the market due to higher demand for innovative, flavorful, and healthier options, which is helpful for the growth of the market.

Asia Pacific is observed to be the fastest-growing region in the foreseeable period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to growing disposable income, higher demand for plant-based options, and higher demand for innovative and flavorful choices. Higher demand and easy availability of different types of clean-label, healthy, and functional options of bacon flavors in the region are another major factor for the growth of the market. China has made a major contribution to the growth of the market due to higher demand for smoky flavor profiles and higher demand for bold and rich flavors by consumers in the region.

Trade Analysis for the Bacon Flavors Market

What Is Actually Traded (Product Forms and HS Proxies)

- Bacon flavoring materials — concentrated flavor compounds, essences, and extracts formulated to impart bacon-like taste profiles in food products are typically classified under HS 21069060 (food flavoring material products) when traded as food-grade ingredients. This code is widely used for edible flavor-formulating substances.

- Food flavoring substances that include bacon flavor among broader savory flavor portfolios may also be recorded under HS 21069099 (other food preparations not elsewhere specified) when blended with other ingredients.

- Natural and synthetic flavour compounds used as raw materials for bacon flavor formulations—including smoke, hickory, or maple notes — may fall under HS 330210 (mixtures of odoriferous substances for industry use) when exported/imported in concentrated forms for industrial flavor manufacture.

- Finished bacon ingredient blends destined for food manufacturers remain categorized primarily under Chapter 21 flavoring headings when incorporated into seasoning systems, sauces, snacks, or meal enhancers with flavor profiles. Trade records often show use of multiple flavor-related HS codes within Chapter 21.

-

Ancillary packaging materials (e.g., pails, drums, and bags for powdered or liquid bacon flavors) are traded under packing-specific HS codes such as HS 3923 (plastic sacks) or HS 4819 (cartons) and are excluded from core flavor product totals.

Top Exporters (Supply Hubs)

- United States: A key exporter of bacon flavoring ingredients and savory flavor systems into global food manufacturing industries, supported by a mature flavor and extracts sector. Market data for general flavoring materials shows substantial U.S. presence in flavor export listings.

- China: Exporter of food flavoring materials, including savory and meat-associated flavor components, often supplied under food preparation HS codes to beverage and snack producers abroad.

- European Union countries (e.g., Netherlands, Germany): Strong exporters of specialized bacon flavor ingredients and compound flavor bases manufactured through established food ingredient clusters. Reflective of broad flavor export trends in Chapter 21.

- India: Emerging supplier of bacon flavor blends and general food flavoring materials to regional processing and snack industries. Records for flavor imports/exports under 2106 suggest diverse flows.

-

South Korea and Japan: Notable flavor ingredient exporters for regional cuisine products, including savory flavor compounds with smoky profiles.

Top Importers (Demand Centres)

- United States: Large importer of bacon-flavored ingredients for use in snacks, sauces, ready meals, and meat analogue products. Trends in flavor imports under HS 21069099 show high demand.

- European Union: Major importer of bacon flavoring materials, reflecting demand in food processing sectors across member states. Flavor import data under Chapter 21 indicates significant EU volumes.

- Japan: Imports specialized flavor compounds, including bacon and smoke-associated flavor profiles, for use in retail foods and culinary applications.

- Southeast Asia (e.g., Vietnam, Thailand): Growing demand for bacon-flavored ingredients tied to retail snacks, seasoning mixes, and convenience foods.

-

Middle East: Importer of savory flavoring systems, including bacon flavor compounds for foodservice and industrial food production.

Typical Trade Flows and Logistics Patterns

- Flavor concentrates and extracts are shipped in sealed drums or containers via containerized sea freight from production hubs to destination markets.

- High-purity flavor compounds may be transported by air freight when rapid replenishment is required for processing lines.

- Regional flavor formulation hubs repack, adjust concentration, and mix flavor systems tailored to local ingredient and regulatory requirements before final sale.

- Distribution networks link exporters of flavor materials with global food producers, seasoning houses, and contract formulators.

Trade Drivers and Structural Factors

- Growth in processed foods and snacks drives demand for bacon flavor profiles in savory and convenience product segments. Global market analyses project expanding consumer appetite for bold and smoky flavors.

- Clean-label trends incentivize the development and trade of natural bacon flavor derivatives alongside synthetic compounds.

- Plant-based meat alternatives and indulgent snack innovation increase reliance on imported bacon flavor systems to replicate traditional taste experiences.

- Cost competitiveness of ingredient producers influences sourcing strategies for manufacturers looking to balance quality and price.

Regulatory, Quality, and Market-Access Considerations

- Bacon flavors must comply with national food safety standards, including permissible ingredient lists, concentration limits, and labeling requirements for flavoring agents.

- Classification under specific HS codes (e.g., 21069060 vs 21069099 vs 330210) directly affects tariff treatment, duty rates, and customs documentation.

- Importing countries may require certification or testing data to verify the food-grade status of flavor compounds before release.

- Flavor ingredients used in meat alternatives may also be subject to novel food evaluations in some jurisdictions.

Government Initiatives and Public-Policy Influences

- Policies promoting food innovation and export competitiveness indirectly support flavor ingredient sector growth.

- Public health and nutrition frameworks influence acceptable ingredient definitions and labeling norms, affecting the bacon flavor trade landscape.

-

Trade facilitation agreements and harmonized customs procedures reduce frictions in moving flavoring materials across borders.

Bacon Flavors Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 6.3% |

| Market Size in 2026 | USD 1.59 Billion |

| Market Size in 2027 | USD 1.69 Billion |

| Market Size in 2030 | USD 2.04 Billion |

| Market Size by 2035 | USD 2.76 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Bacon Flavors Market Segmental Analysis

Flavor Type Analysis

The smoke flavor segment led the bacon flavors market in 2025, due to higher demand for smoky, bold, and authentic flavor profiles in different types of processed food options, fueling the growth of the market. Technological advancements help to infuse smoky and bold flavors without using any traditional methods that may not be cost-effective, further fueling the growth of the market in the foreseeable period.

The Hickory segment is observed to be the fastest-growing region in the foreseen period, due to its rich, dominant, and smoky flavor profile, fueling the growth of the market. Such flavor profiles are ideal for meat and barbecue preparations, further helpful for the growth of the market. Higher demand for the combination of sweet and spicy is one of the major factors fueling the growth of the market. Availability of the flavor in different forms, such as sauces, spreads, and even flavored salts, is another major factor propelling the growth of the market in the foreseen period.

Application Analysis

The meat products segment led the bacon flavors market in 2025, due to higher demand for meat, processed food, and convenient food options by consumers with a hectic lifestyle. Ready-to-eat processed and convenient food options, by consumers with a hectic lifestyle who wish to have flavorful options, also help to propel the growth of the market. Higher demand for options that can be easily prepared and served to save time and avoid starving in flavorful options is one of the major segments for the growth of the market. Higher demand for rich and savory meat options in household kitchens also helps to fuel the growth of the market in the foreseeable period.

The potato chips and snacks segment is expected to grow in the foreseeable period due to higher demand for potato-based innovative snack options by consumers of all age groups. Such snack options are easy, processed, and convenient, ideal for consumers with a time crunch, and further helpful for the growth of the market. Higher demand for functional and healthier snack options to have mindful munching also helps propel the growth of the market.

Distribution Channel Analysis

The hypermarkets and supermarkets segment led the bacon flavors market in 2025, due to the easy availability of such stores near residential areas, allowing consumers to shop from them easily. Such stores have different types of product categories arranged in a clean format, allowing consumers to scan through the newly launched and innovative options, further fueling the growth of the market. Such stores also provide heavy discounts to their loyal customers to retain them, which is helpful for the growth of the market.

The online retail segment is expected to grow in the foreseeable future due to the convenience provided by the platform, allowing consumers to shop for different types of innovative options from the convenience of their home. The platform has a huge product portfolio, allowing consumers to browse through a variety of products, which is further helpful for the growth of the market. Hence, such factors altogether help to fuel the growth of the market in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

-

Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Key Market Participants and Their Strategic Impact

- Nestlé S.A. (CH): Nestlé is a global food and beverage leader with a broad portfolio spanning prepared meals, snacks, and culinary products, supported by strong R&D and global distribution capabilities. Its scale enables rapid integration of bacon flavor systems across multiple categories, including ready meals and savory snacks. Strategically, Nestlé’s focus on clean-label innovation and localized taste adaptation strengthens demand for natural and smoke-based bacon flavors worldwide.

- Unilever PLC (GB): Unilever operates a strong nutrition and culinary portfolio through brands such as Knorr and Hellmann’s, with deep expertise in flavor-driven sauces, seasonings, and meal solutions. The company’s emphasis on taste enhancement, sustainability, and health-forward reformulation positions bacon flavors as a value-adding component in savory and hybrid products. Strategically, Unilever’s global reach allows bacon flavor profiles to be tailored for regional cuisines and consumer preferences.

- General Mills, Inc. (US): General Mills is a leading packaged food manufacturer with a strong presence in snacks, cereals, and prepared foods, known for continuous product innovation and brand collaborations. The company leverages bacon and smoky flavor profiles to enhance indulgence and differentiation in snacks and breakfast offerings. Strategically, its innovation-led approach supports expanded use of bacon flavors in convenience and lifestyle-oriented food segments.

- Hormel Foods Corporation (US): Hormel Foods is a major player in meat and protein-based products with deep expertise in savory flavor development and branded bacon offerings. Its focus on product innovation, premiumization, and strategic partnerships strengthens its leadership in authentic and bold bacon flavor profiles. Strategically, Hormel plays a key role in advancing bacon flavor applications across traditional meat, value-added, and emerging hybrid categories.

-

Danone S.A. (FR): Danone is a global food company focused on dairy, nutrition, and plant-based products, with a strategic emphasis on health-driven innovation. While traditionally aligned with wellness segments, Danone’s expansion into high-protein and plant-based categories creates opportunities for savory and bacon-style flavor integration. Strategically, the company’s science-led approach supports the development of balanced, health-conscious bacon flavor applications.

Segments Covered in the Report

By Flavor

- Smoke

- Hickory

- Applewood

- Natural

- Maple

By Application

- Meat Products (Bacon)

- Potato Chips and Snacks

- Dairy Products

- Bakery Products

- Sauces and Marinades

- Seasonings and Spices

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retailers

- Food Service Providers

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5998

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.